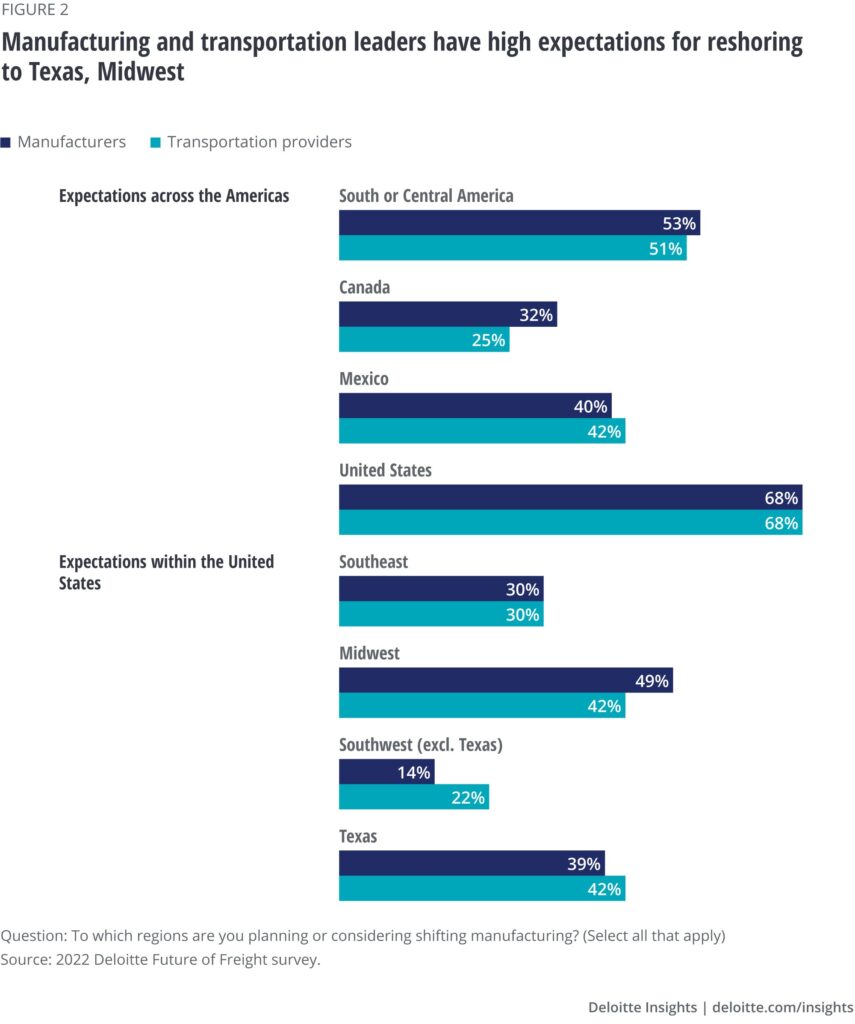

Nearshoring to North America enables companies to become less dependent on supply chains in Asia. According to Bloomberg citing a report from Deloitte, US firms expect to re-shore almost 350,000 jobs. That is an increase of 25% from 260,000 in 2021. According to the report, manufacturing and transportation executives except freight from Asia to move onshore or nearshore. The move back to North America will alleviate supply chain challenges and improve competitive positioning.

Read More